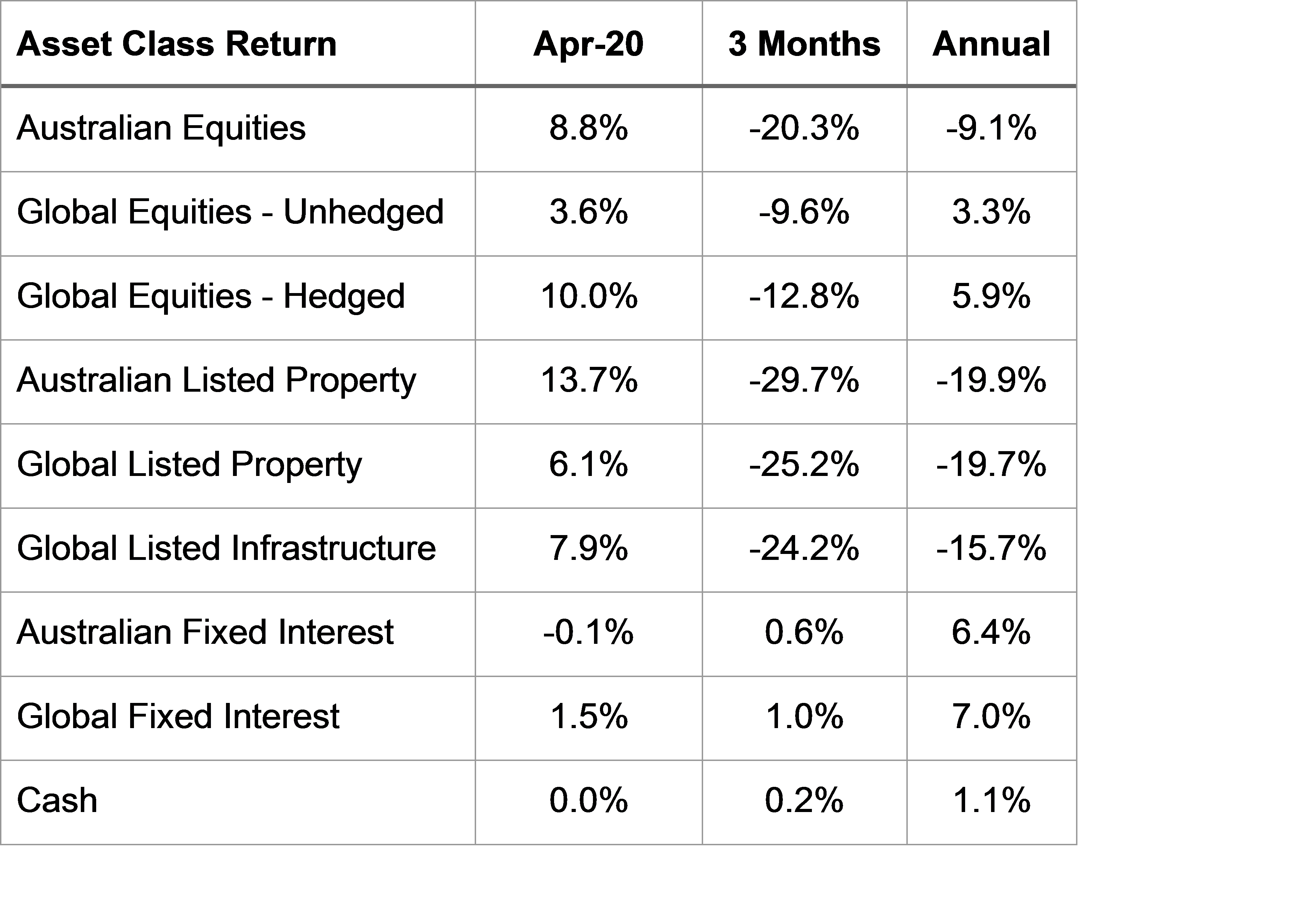

- Market performance across the asset classes improved considerably in April. The Australian fixed interest asset class was the only one to decline in the month after a torrid March.Global equity markets generally maintained a positive trend following Congress’ approval of the US rescue package on March 23rd.

- A strong rally in the $A resulted in returns from currency hedged global equities being well above unhedged returns.

- The domestic equity market has responded positively to indications the impact of COVID-19 will pass earlier than expected.

International Equities

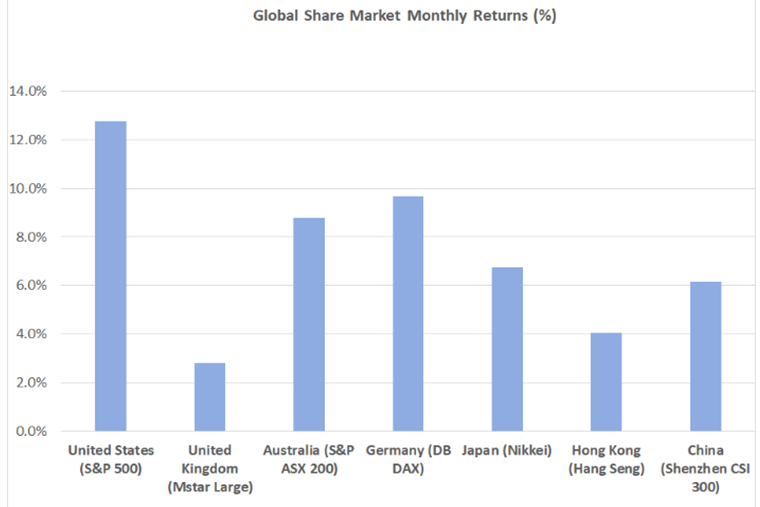

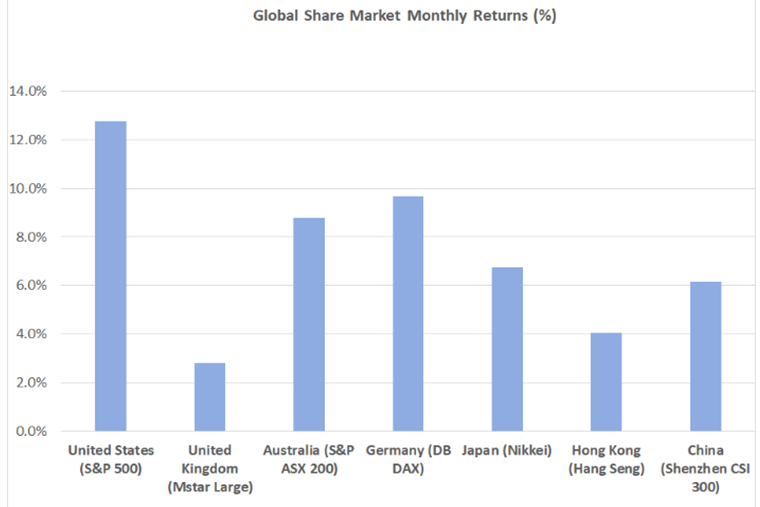

Share markets rose strongly in April, building on a strong bounce at the end of March. However, despite this emphatic response to government and central bank support, day to day volatility is still elevated and hence the recovery can still be characterised as fragile. The technology heavy U.S. markets were the strongest, with the NASDAQ index – dominated by technology companies and particularly by Microsoft, Facebook, Google, and Amazon – returning 15.4%.

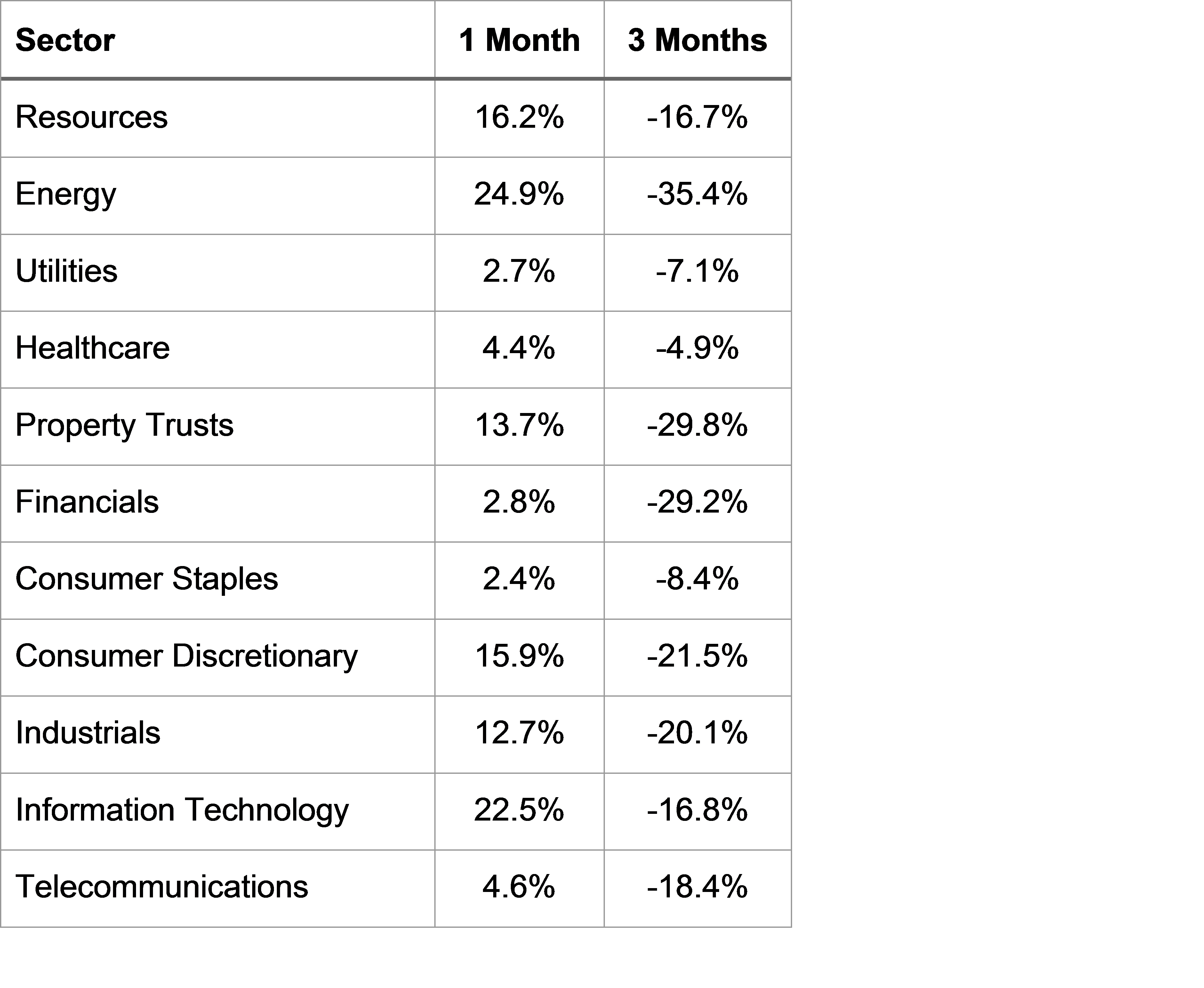

All sectors were positive, however the more stable Communication, Health Care, Financials, Utilities and Staples groups returned 2.4% to 5% - all well below the market average. Notably the property trust sector also bounced back strongly, delivering 13.7% for the month as investors came to grips with the likely impact on property values and cashflows of lower levels of commercial and retail activity. However, such was the magnitude of the sell-off in property trusts in March that the sector still remains down 31% for the quarter.

This was well ahead of the broader U.S. S&P 500 Index return of 12.8%. Technology companies have been less affected, or even benefited from, the impact of COVID-19 on commerce. Although not as strong as the U.S. market, other developed economy markets performed well with average increases of 5% across Europe and nearly 7% in Japan. Emerging markets also performed well, with China (up 6.0%), India (up 15.3%) and Korea (up 8.3%) all contributing positively.

Australian Equities

The Australian market performed well, rising 8.8%. overall. The Energy sector was clearly the strongest as oil prices stabilised, and quarterly production updates gave management the chance to report to shareholders on (largely) incident free trading and production activity. Information Technology was also up substantially with investors rewarding their resilient business models.

A feature of recent weeks on the Australian market has been an increase in equity issuance, which is in contrast to a lengthy period prior to the Coronavirus crisis when buybacks helped shrink shares on issue. New share issues help strengthen the balance sheet position of companies, enabling them to navigate a period of falling revenue more successfully. These share issues can also provide an opportunity for investors, with the new capital often issued at a price below the prevailing market value.

However, non-participation in new equity raises by investors will generally result in dilution of ownership and a smaller participation share in future profits. Of the major banks, NAB is so far the only bank to announce a new share issue, with Westpac and ANZ using dividend deferral to increase capital. We expect that ANZ and Westpac will make every effort to pay some form of dividend before the next result but APRA’s (the banking regulator) direction to conserve capital will take precedence until the outlook is clearer.

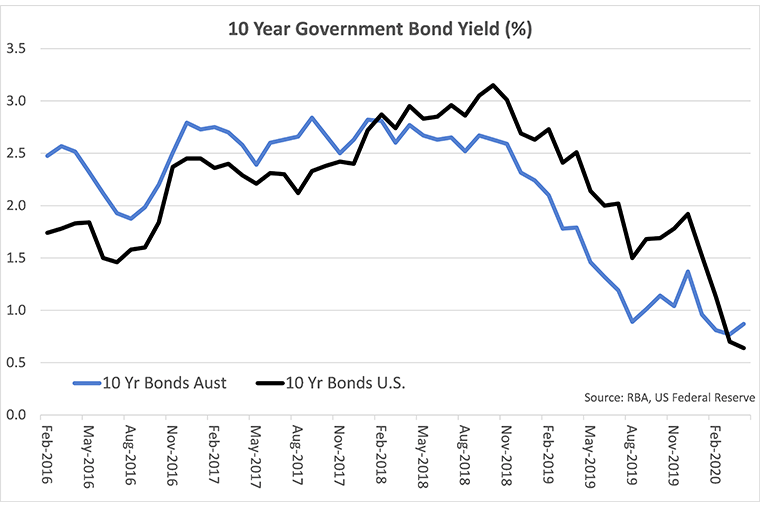

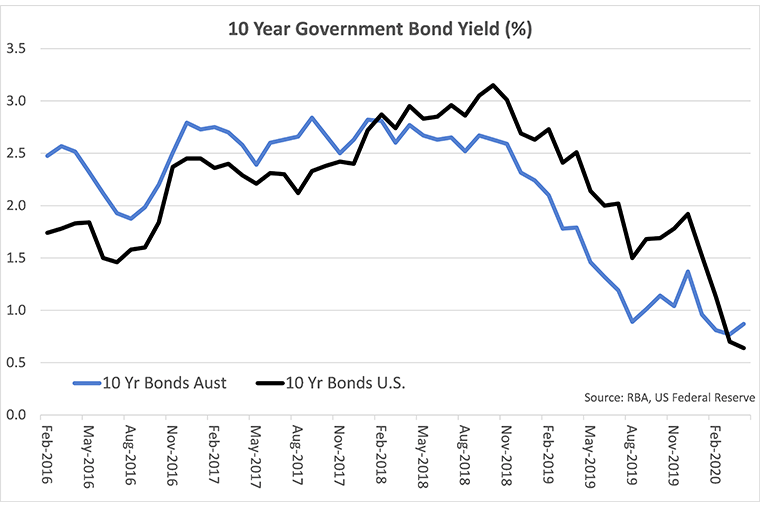

Global and domestic bond markets were relatively flat last month. Interest rates on government bonds are essentially mandated to remain at low levels on short-term securities, while new issuance (supply) of government debt is suddenly now at record levels. When the supply of bonds increases there is less scope for bond prices to rise (and yields to fall). This is particularly relevant at the longer end of the yield curve, which is less subject to interest rate targeting by central banks. The 10-year Australian Government Bond yield finished April 0.10% higher at 0.87%, whereas the equivalent U.S. yield fell by 0.06% to 0.64%.

The widening of the gap between longer term Australian and U.S. interest rates may have been one factor supporting a rally in the $A last month. A recovery in oil and other commodity prices, together with an improved growth outlook, may have also contributed. The bounce back in the $A over April from U.S. 61.8 cents to U.S. 65.7 cents reversed all of the decline recorded in the month of March. The $A was also 5% stronger against the Japanese Yen and 8% stronger against the Euro.

Conclusion

As was the case with equity markets, improved sentiment supported the value of credit securities, which pared back some of the losses recorded in March. The market for corporate credit (company debt) securities continued to benefit from central bank support. The Australian Reserve Bank recently announced its willingness to broaden the range of security types it will consider eligible for purchase under its program to include securities issued by non-bank corporations with an investment grade credit rating.

The general improvement in sentiment over April was consistent with the evidence of a peaking in the infection rate of the Coronavirus around the globe, and a broader sense that the path to normality has commenced. Notwithstanding this improved sentiment, uncertainty and risks remain elevated and there will now be considerable focus on real economic data and company results to try and narrow down this range of unknown outcomes.

Important Information

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. If you decide to purchase or vary a financial product, your financial adviser, Hillross Financial Services Limited and other companies within the AMP Group may receive fees and other benefits. The fees will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Please contact us if you want more information. Prosperity Wealth Advisers Pty Ltd (ABN 32 141 396 376), Authorised Representative and Credit Representative of Hillross Financial Services Ltd, Australian Financial Services Licensee and Australian Credit Licensee 232 706.