NEW Compliance and ‘Risk Assessment’ Guidelines are set to apply from 1 July 2021.

The Australian Taxation Office (ATO) recently published a revised draft set of Compliance Guidelines to assist professional services firms or practices self-assess the ‘level of compliance risk’ involved with their profit-sharing (income-splitting) arrangements.

The ATO is primarily concerned with arrangements where, without good commercial reasons, the compensation received by an individual professional practitioner (called an “IPP”) is deemed to be ‘artificially low’ due to income-splitting arrangements with related entities, resulting in an ultimate tax-minimisation benefit for the IPP. These revised ATO guidelines follow earlier pronouncements in 2014 and 2017.

As you would expect, there is a degree of complexity to these rules which will need to be digested and several tax calculations which will need to be performed in order to complete the risk-assessment process. This process will need to be conducted annually, based on the prior year’s pattern of distributions.

1. Eligibility conditions:

Satisfaction of the preconditions means that you can then self-asses your compliance risk.

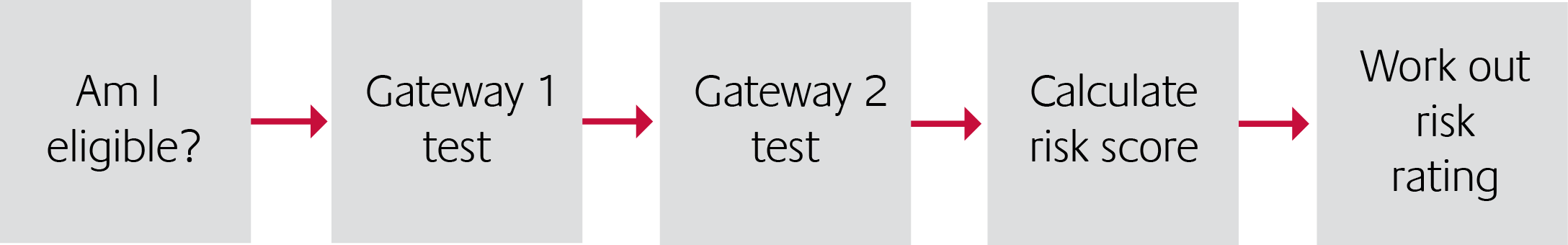

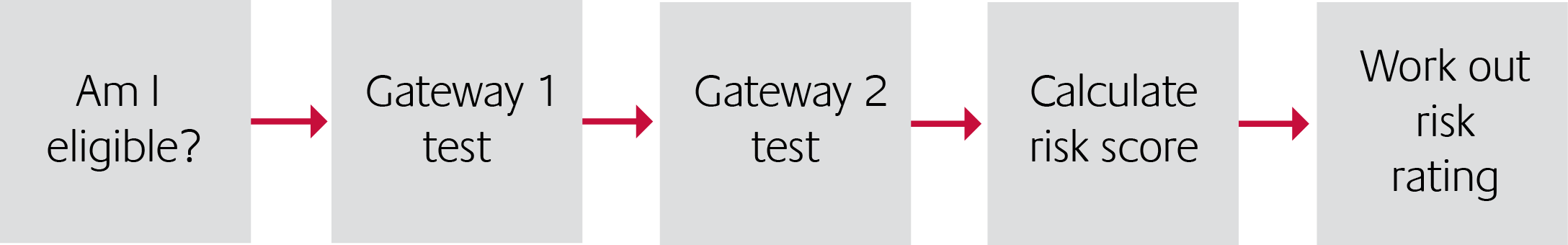

2. Passing of the two ‘Gateways’:

Two "Gateways” have been introduced as part of the compliance approach.

ii. Gateway 2 – you must assess whether your arrangement contains any high-risk features, such as non-arm’s length transactions, use of multiple classes of shares and units and any activities covered by a Taxpayer Alert.

Example – a financing arrangement involving associated entities in order to give rise to a tax benefit would be high-risk.

Only firms which pass both Gateways will be eligible to make use of the Risk-Assessment approach set out below.

3. The Risk-Assessment approach:

Step 1: - Calculate your Risk Score

Step 2: - Determine your ‘Risk Level’

The aggregate score under the above tests will then determine the risk zone and level that applies to you. The aggregate score will depend on whether you apply only the first two tests or all three.

Step 3: - Set your expectation of ATO’s engagement based on your the Risk Level

Are there any TRANSITIONAL arrangements?

Yes - the good news is that certain arrangements which were considered low risk under the previously suspended Guidelines (issued back in 2017), but which now attract a higher risk rating, may still be able to be continued up until 30 June 2023, provided that the arrangements are commercially-driven and do not exhibit any high-risk features (ie. they pass the two Gateways above).

How can Prosperity HELP?

The Australian Taxation Office (ATO) recently published a revised draft set of Compliance Guidelines to assist professional services firms or practices self-assess the ‘level of compliance risk’ involved with their profit-sharing (income-splitting) arrangements.

Whilst the draft Guidelines are still under consultation, we have set out below our answers to current questions we are fielding on this topic.

WHY have the new Guidelines been issued?

The ATO are already gearing-up a dedicated team to identify any arrangements that fall outside these new Guidelines. As a result, understanding the full application of these new compliance measures on your arrangements will be crucial, as your risk rating under the Guidelines will determine the level of ‘ATO engagement’ you should expect in reviewing your arrangements.

Professional services firms are also be required to self-assess their level of risk on an annual basis and document their assessment for compliance purposes in the event of any future ATO reviews and audits.

TO WHOM do the Guidelines apply?

The Guidelines will apply to ALL professional services firm arrangements – including (but not limited to) medical, financial services, legal and accounting professions who carry out any income-splitting activities within their business structures.

They will apply prospectively from 1 July 2021 (so for the 2021-22 tax year onwards).

What are my next STEPS?

Below is a quick summary of some of the key steps and items that will need to be reviewed:

A review of your overall arrangements will need to be undertaken to ensure that you satisfy all the requirements and preconditions to be eligible to use the ATO’s risk-assessment approach.

This will include a review of your overall business structures and consideration of whether the income being generated is personal services income (PSI) which should be dealt with under the existing PSI rules.

Satisfaction of the preconditions means that you can then self-asses your compliance risk.

i. Gateway 1 – you must be able to demonstrate that there is a genuine commercial rationale for the way your professional services firm is structured and for the way the profits are distributed. The legal form of the arrangement must be consistent with how the firm operates in practice.

Example - an arrangement that appears to serve no real purpose other than to simply provide a tax advantage may be viewed by the ATO as an arrangement that lacks commercial rationale.

ii. Gateway 2 – you must assess whether your arrangement contains any high-risk features, such as non-arm’s length transactions, use of multiple classes of shares and units and any activities covered by a Taxpayer Alert.

Example – a financing arrangement involving associated entities in order to give rise to a tax benefit would be high-risk.

Only firms which pass both Gateways will be eligible to make use of the Risk-Assessment approach set out below.

3. The Risk-Assessment approach:

The Guidelines apply a score (from 1-6) to each answer you give to the following questions (which we have rephrased for explanatory purposes):

i. What proportion (%) of the profit share from the firm has been specifically allocated to the IPP (as opposed to other family members or entities)?

iii. *Optional factor – How does the level of remuneration paid directly to the IPP by the firm compare to other commercial benchmarks or remuneration to other parties for similar services

i. What proportion (%) of the profit share from the firm has been specifically allocated to the IPP (as opposed to other family members or entities)?

- The higher the percentage, the lower the score

ii. What is the total effective tax rate being paid by the IPP and associated entities on income received from the professional services firm (excluding other income & deductions)?

- The higher the overall tax rate, the lower the score

- Remuneration below comparable market benchmarks will attract a higher score.

* ATO recognises this factor is difficult to determine accurately and therefore the use of this is optional. It will only prove useful if you score poorly on the first two ratings.

Step 2: - Determine your ‘Risk Level’

The aggregate score under the above tests will then determine the risk zone and level that applies to you. The aggregate score will depend on whether you apply only the first two tests or all three.

- Green Zone = Low Risk

- Amber Zone = Moderate Risk

- Red Zone = High Risk

As an example, using only the first two tests, an IPP who:

- Allocates 51% of the firm profit to himself and whose family group pays an average of 31% tax on the firm income would receive an aggregate score of 7 (low risk Green Zone)

- Allocates 50% of the firm profit to himself and whose family group pays an average of 29% tax on the firm income would receive an aggregate score of 9 (high risk Red Zone)

- Low Risk - ATO will review in exceptional circumstances

- Moderate Risk - ATO may contact you to conduct further analysis

- High Risk - Expect ATO audits and reviews to commence as a matter of priority

Otherwise, there are transitional arrangements in place until the end of the current financial year (30 June 2021), provided that the 2021 arrangements still comply with the 2017 suspended Guidelines.

How can Prosperity HELP?

The ATO have advised that that they are continuing to identify taxpayers who may fall outside these Guidelines and have put in place a dedicated team to oversee and manage profit-allocation arrangement risks. Accordingly, it is important to review your current income allocation arrangements before 30 June 2021 and in particular if you are considering any restructure of your operations. We will be conducting an assessment and documentation process for all our existing clients and welcome any queries you may have in relation to how these rules may apply to you.