Many patients seek a second opinion or diagnosis confirmation before treatment for a complex condition. There is a level of comfort to be gained in seeking advice from a recognised specialist in your particular medical issue - someone who has the experience and background to pass a fresh set of eyes across the facts and perhaps offer an alternative approach or insight.

We think the same concept makes perfect sense when it comes to the important and often complex issue of your own financial affairs. Shouldn’t you make absolutely sure you are getting the best advice from recognised specialists with deep industry knowledge? What might a second opinion reveal about your own planning and strategies?

Our complimentary Health Check

The Prosperity Health team specialises in providing tailored accounting, tax and advisory services to medical professionals and their teams throughout Australia. Recognised as a medical speciality firm with deep industry knowledge, we have a strong track record in delivering services to a range of industry participants including registrars, GPs and medical specialists, dentists and dental specialists, medical centres, day hospitals and allied health professionals.

We believe in the value we can bring to a new advisory relationship but understand that we need to demonstrate that value up front to gain your trust and engagement. Our complimentary Health Check offers the ideal opportunity for you to share your plans, financial details, existing structures and requirements with us so we can provide ideas and insights on how we might work together to build a stronger financial future for you and your family.

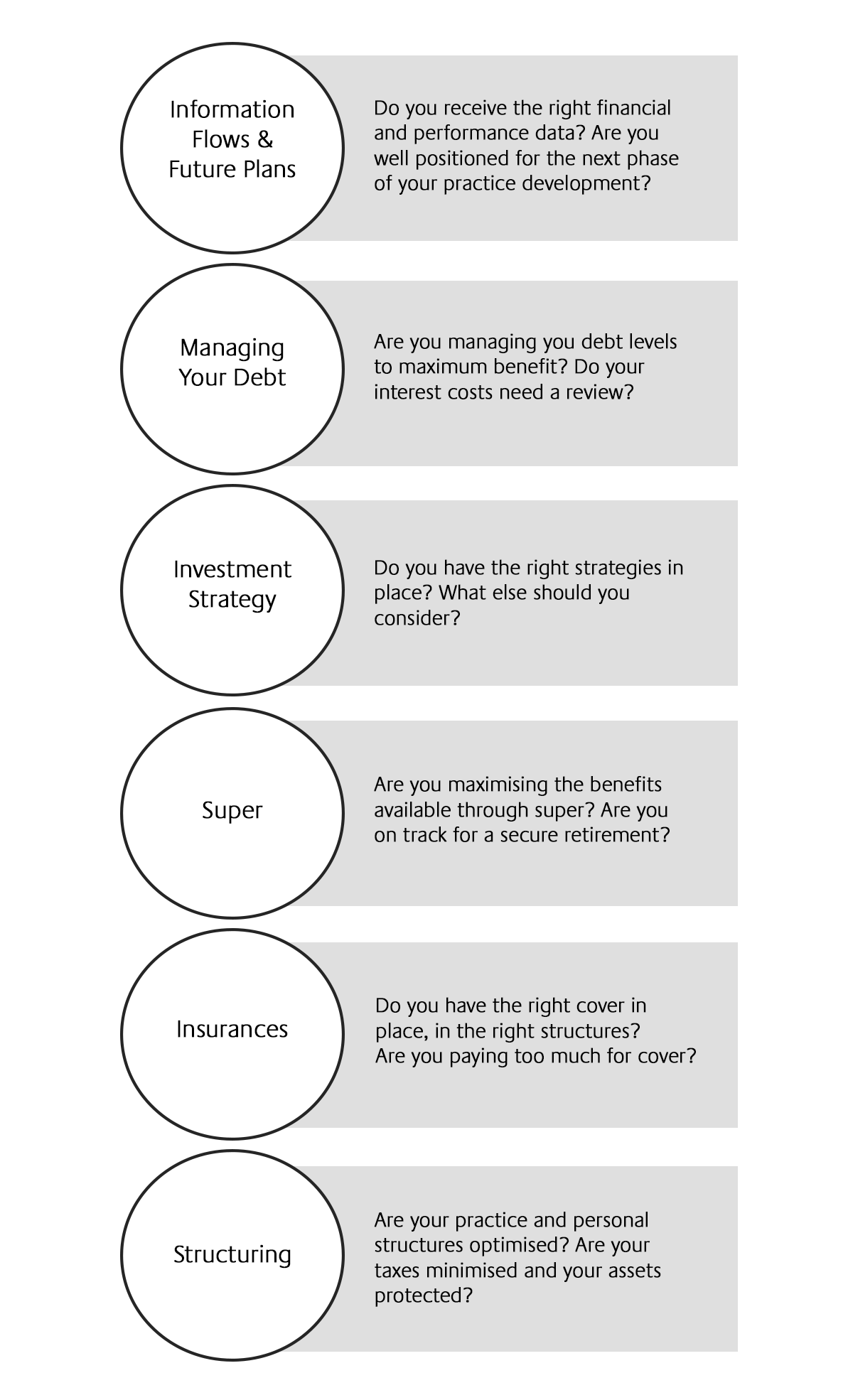

We bring together both financial and tax advisory specialists and will typically cover the following areas:

- Insurance pricing and levels reviewed and adjusted to improve cover – Specialist

- Identified deficiencies in existing estate plans and implemented new plan – Specialist

- Estate plan updated to better protect beneficiaries and reflect practice structures – Specialist

- Identified $17,000 of additional tax savings – GP

- Improved tax efficiency of investment structures, resulting in better long-term growth prospects – GP

- Asset structuring to improve and maximise tax deductions – GP

- Diversified investment portfolio by re-cycling debt from non-deductible to deductible – GP

- Loan restructure, improving tax deductible share of debt by $600k – Surgeon

- Asset restructure to improve protection and lock in $1m of permanent tax saving on asset value – Surgeon

- Reviewed Family incomes focussing on employees and entity structure to deliver $16K tax savings for Group. – Surgeon

- Restructuring an Estate plan and developing Will to ensure best results for beneficiaries – Surgeon

Please click here to start the process on your complimentary financial health check.